Are you tired of juggling your bills, income, savings, and expenses in your head?

Have you ever forgotten to pay a bill or lost track of how much you’ve spent in a month?

At some point, did you wonder if there’s a better way to manage your money, but without having to be constantly online?

If so, you’re not alone!

Many people are in search of an effective way to handle their finances that doesn’t require an always-on internet connection.

Well, we’ve got you covered.

We have compiled some of the best software programs that are designed to help you manage your money, track your spending, and plan for the future, all while providing the comfort of data privacy without the need for a continuous internet connection.

These offline personal finance software options are perfect for those who prefer to manage their finances in their own time, at their own pace, without worrying about being always connected to the internet.

And The best part is…all of them are FREE and open-source software! (Meaning, you can download and use them entirely for free without paying a dime…ever!)

How to Choose the Best Personal Finance Software?

When it comes to managing your money, having the right tool can make all the difference.

Choosing the best personal finance software depends on your financial goals, lifestyle, and personal preferences.

Here’s how you can navigate the process of selecting the right one for you.

Understand Your Financial Needs

Before diving into the sea of options, it’s important to have a clear picture of your financial needs.

Are you looking for a tool to help budget your personal expenses?

Or, are you in need of a robust platform to manage your small business?

Understanding what you require from finance software will guide your choice.

Check the Features

Different personal finance software offers different features.

Some are designed for simplicity with basic budgeting and expense tracking, while others offer comprehensive features such as investment tracking, bill payment, and complex financial reports.

Make sure the software you choose has the features you need.

User-Friendliness

The ideal personal finance software should be user-friendly.

If the interface is too complex, it can be a hassle to manage your finances.

Always choose software that has a clear, intuitive layout and straightforward navigation.

Security Measures

When dealing with personal financial data, security is of utmost importance.

Look for software with robust security measures in place, including strong encryption, password protection, and two-factor authentication.

Pricing

Many personal finance apps offer a range of pricing models, from free to monthly or yearly subscriptions.

While free options can be a great option to start, they may lack certain features as well.

On the other hand, paid options often come with more features and better customer support.

Decide what’s worth paying for based on your needs and budget.

Platform Compatibility

Make sure the software is compatible with your preferred devices.

Whether you want to manage your finances on a desktop computer, a smartphone, or both, ensure the software you choose supports your platform.

Best Offline Personal Finance Software

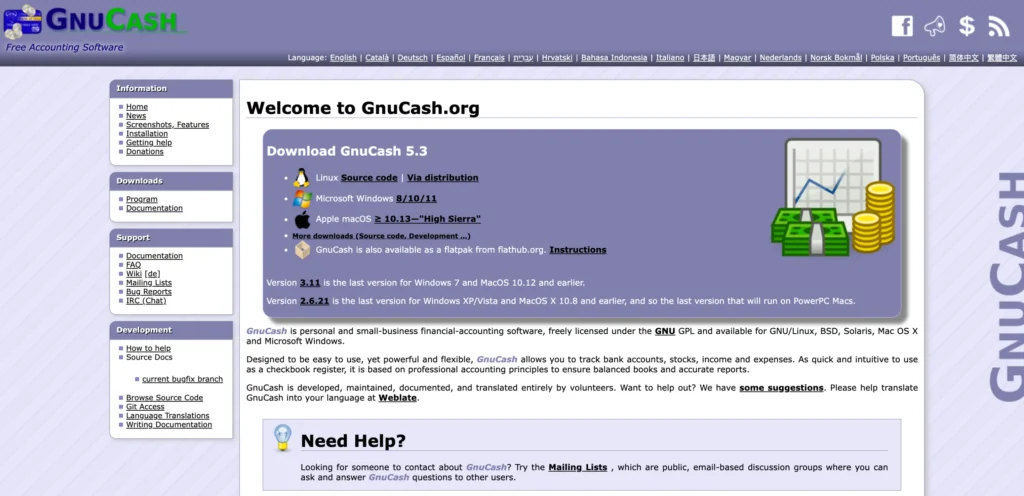

1. GnuCash

GnuCash is a free and open-source accounting software that can help you manage your personal or small business finances.

It offers double-entry accounting, which is something professionals often use but it’s simplified for everyday folks too.

GnuCash helps you keep track of where your money is coming from and where it’s going.

Whether you want to keep an eye on your daily spending or make sure your business’s books are in order, GnuCash has the tools to help you do it.

You don’t have to be an accountant to use it, and it doesn’t talk down to you with jargon or complex functions.

Key Features

- Easy-to-use interface

- Double-entry accounting

- Track investments

- In-built reporting tools

PRICING PLAN

100% FREE – Freely licensed under the GNU GPL and available for GNU/Linux, BSD, Solaris, Mac OS X, and Microsoft Windows.

• Double-Entry Accounting.

• Stock/Bond/Mutual Fund Accounts

• Small-Business Accounting

• Reports, Graphs

• QIF/OFX/HBCI Import, Transaction Matching

• Scheduled Transactions

• Financial Calculations

Pros

- Free to use

- Comprehensive features

- Strong community support

Cons

- May have a learning curve for complete beginners

- A bit outdated interface

2. Skrooge

Skrooge is another free and open-source software that offers personal finance management. It’s known for its flexibility and ease of use.

Skrooge lets you manage your money in a way that fits you. It’s adaptable, so you can make it as simple or as complex as you want.

With Skrooge, you can track your spending, savings, and investments, and see it all in clear, easy-to-understand reports and graphs.

Key Features

- Multiple account support

- Graphical reports

- Budget tracking

- Import and export functionality

Pros

- Flexible and customizable

- User-friendly

- Regular updates and support

Cons

- Lack of tutorials or guidance for new users

- Less suitable for business accounting

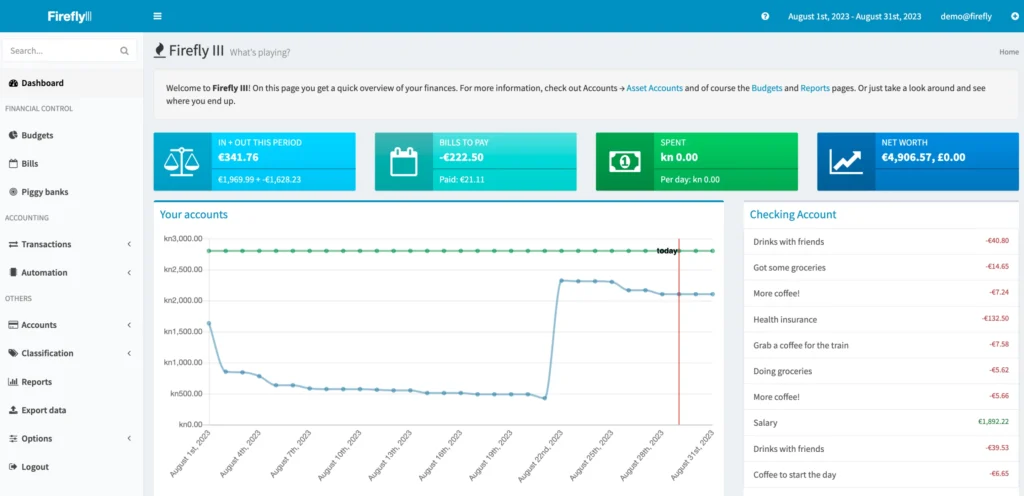

3. Firefly III

Firefly III is a comprehensive and versatile personal finance manager that’s entirely free and open-source. It comes with a double-entry bookkeeping system that makes managing your transactions in multiple currencies a breeze.

It is designed to simplify the complexity of managing money across multiple currencies.

Whether you’re a budgeting pro or just starting to organize your finances, Firefly III offers an inviting platform that has been evolving for over a decade.

It’s not just about tracking dollars and cents; it’s about understanding your financial patterns and making informed decisions.

Key Features

- Full transaction management: Organize your transactions quickly in various currencies.

- Import data from any source: Use the special Data Importer to seamlessly bring data into your Firefly III.

- Advanced rule engine: Convert shorthand to detailed transactions or clean messy CSV files from your bank.

- Budgets, categories, and tags: Whether you prefer tags, categorizing expenses, or budgeting, Firefly III has got you covered. Even multi-currency budgeting is possible.

- Informative reports: Advanced reporting capabilities show your expenses by week, month, or year and provide detailed account audits.

- JSON rest API: The expansive JSON REST API allows advanced users to tap into Firefly III’s main features from any app or system.

PRICING PLAN

100% FREE & OPEN SOURCE PERSONAL FINANCE MANAGER

• Full transaction management.

• Import data from any source.

• Advanced rule engine to quickly convert shorthands to detailed transactions.

• For the advanced and mobile users out there, Firefly III features an expansive JSON REST API that allows you to tap into Firefly III’s most important features.

Pros

- Free, open-source, and feature-rich

- Customizable to personal needs

- Ability to import and organize data seamlessly

Cons

- Might be overwhelming for some new users

- The user interface might require some getting used to

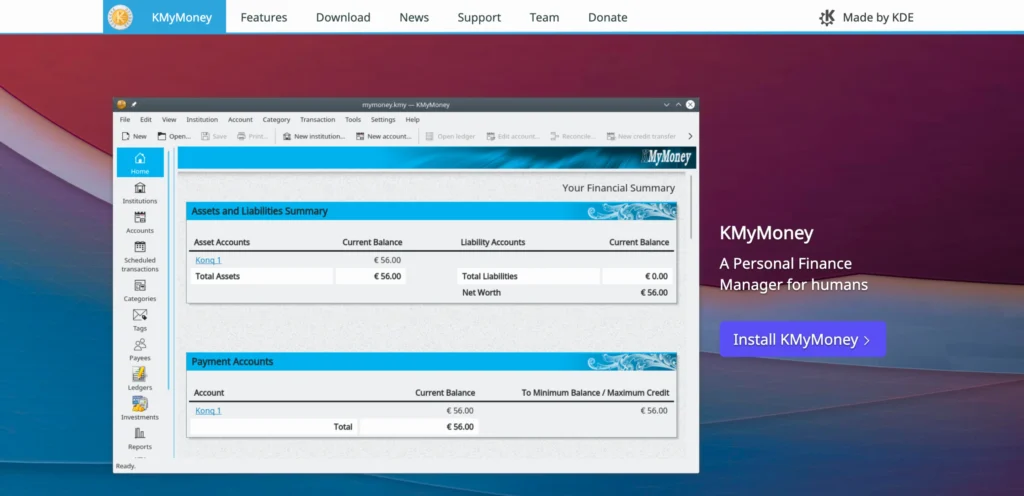

4. KMyMoney

KMyMoney is a personal finance manager designed to provide users with a comprehensive set of financial features.

Developed with the KDE desktop environment in mind, it’s aimed at non-technical users who require a reliable tool to manage their personal finances.

KMyMoney provides a robust and user-friendly solution for personal finance management. It’s designed to be familiar and easy to use, making it a great choice for those who prefer a tool that doesn’t require a deep understanding of accounting principles.

Despite its focus on ease of use, KMyMoney doesn’t compromise on accuracy. Using time-tested, double-entry accounting principles, KMyMoney ensures your finances are recorded correctly.

Key Features

- Double-entry accounting

- Personal financial summary

- Easy management of financial institutions and accounts

- Scheduled transactions for recurring payments

- Comprehensive category management

PRICING PLAN

100% FREE & PERSONAL FINANCE MANAGER FOR HUMANS

• Linux

• Windows

• macOS

• Source code archive

• Git

Pros

- Simple and intuitive user interface

- Broad array of financial features

- Customizable financial summary page

- Accurate using double-entry accounting principles

Cons

- Some users might find it too complex for basic personal finance tracking

- Lack of support for online banking

conclusion

Getting your finances in order isn’t gonna be a walk in the park. It takes discipline, careful planning, and the right tools.

That’s where personal finance software comes in. It ain’t just about tracking where your cash goes. it’s about understanding your spending habits and finding areas where you can save a few bucks.

The “best” isn’t the same for everyone. The best Offline Personal Finance Software for you is one that’s easy to use, meets your financial needs, fits within your budget, and most importantly, helps you manage your money better.

So choose wisely, choose clarity!